Diversifying PACS: Strategies for Multi-Purpose Transformation

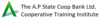

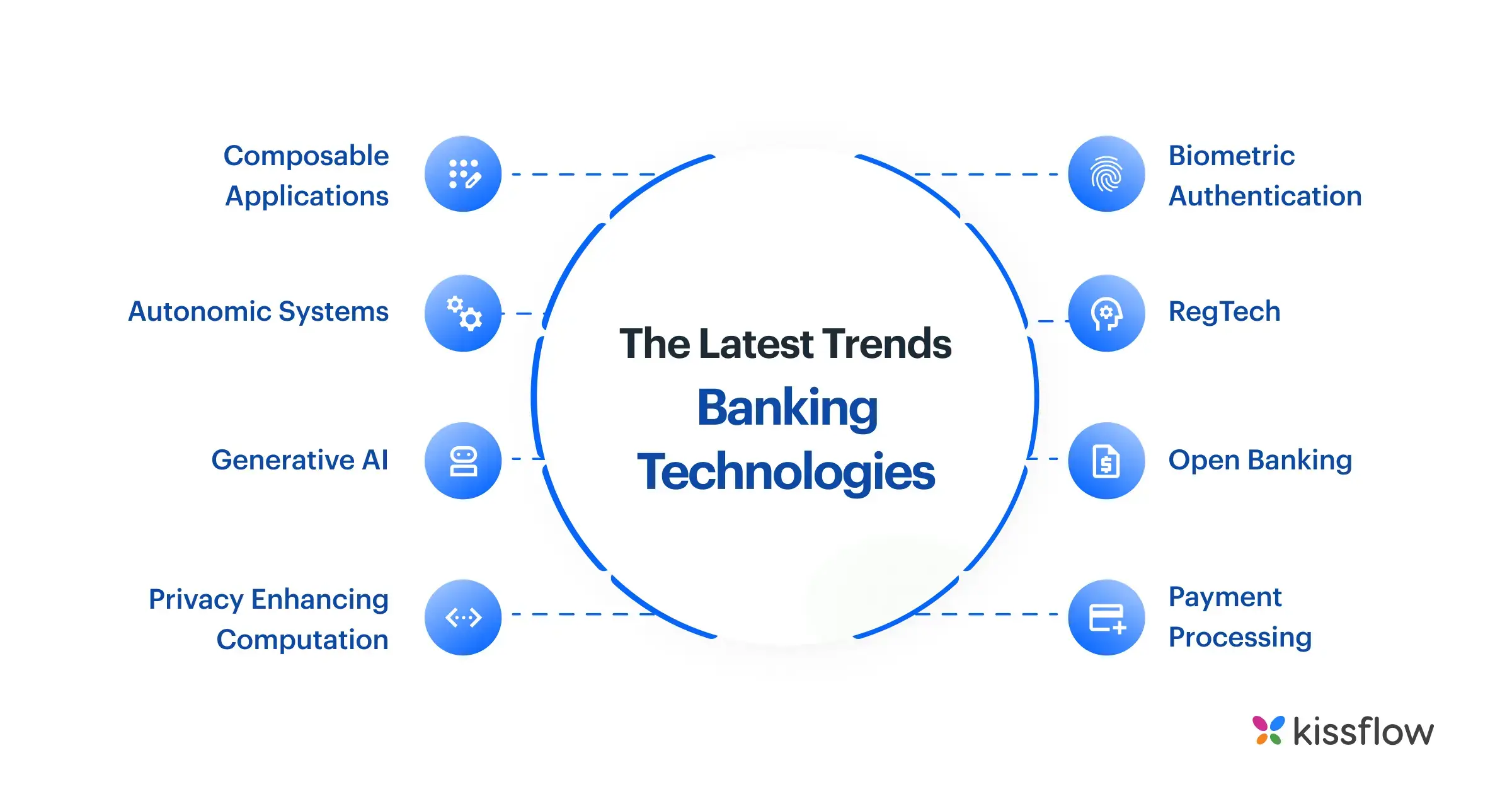

APCOB CTI Centre Hyderabad, IndiaThis program trains PACS staff on transforming Primary Agricultural Credit Societies (PACS) into multi-purpose entities. It covers diversification into agri-input sales, consumer goods, banking services, and storage facilities. The training aims to enhance revenue streams, improve member benefits, and strengthen rural economies.